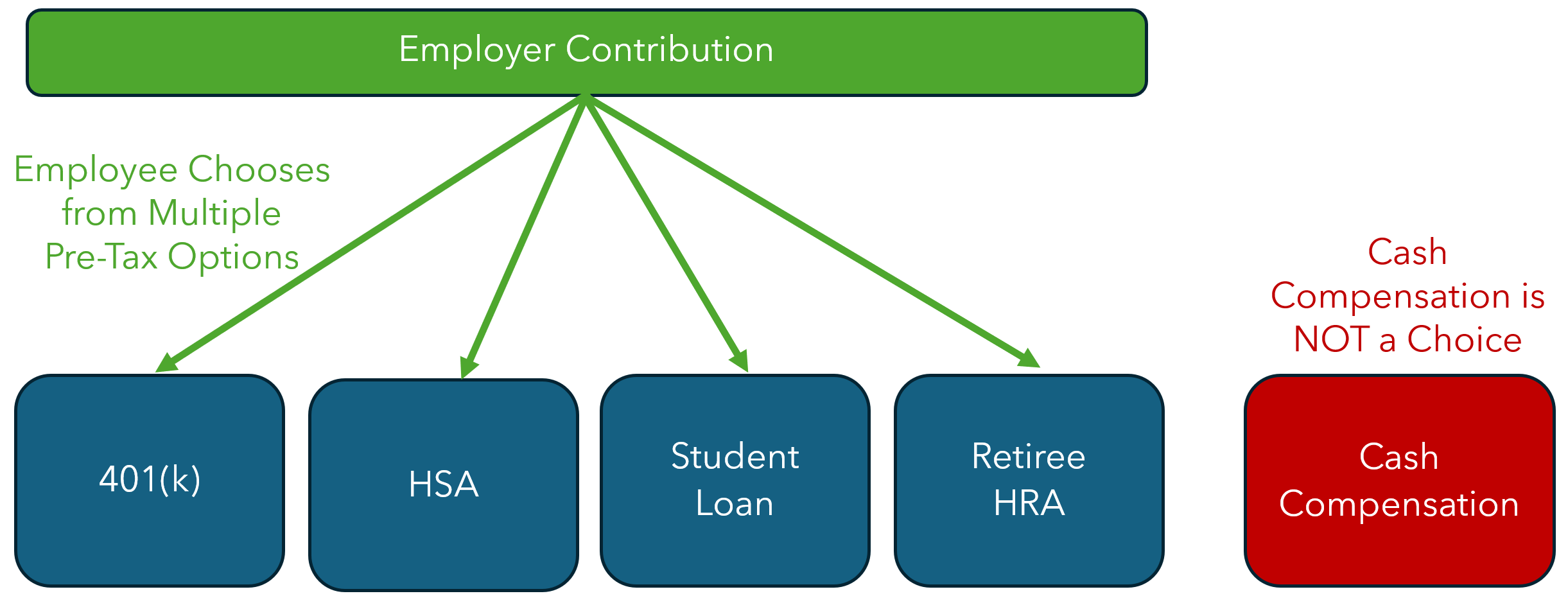

In May 2024, the IRS issued a Private Letter Ruling (PLR 202434006) that permits a unique and flexible pre-tax plan arrangement. The plan design allows employee flexibility in directing a contribution that would otherwise have been a discretionary contribution to the employee’s 401(k) plan. The approved plan permits employees to allocate the employer contribution among the following four (4) pre-tax plan options:

-

Contribution to 401(k) plan (non-matching, non-elective contribution)

-

Contribution to HSA

-

Contribution for student loan reimbursements through an educational assistance plan

-

Contribution to a retiree health reimbursement arrangement (HRA).

The approval of this new flexible choice program is likely to garner attention from employers across the country. Recognizing that employee populations span many life stages and have differing personal goals, employers have long been interested in providing more choice and flexibility for employees.

It is important to note, however, that Private Letter Rulings (PLRs) only apply to the specific taxpayer who requested the ruling. In other words, employers at large cannot adopt similar flexible choice plan designs unless they submit a request for their own PLR from the IRS.

History

The IRS has previously issued two similar PLRs that permitted the choice between a defined contribution plan contribution and a retiree health reimbursement arrangement (HRA) contribution. The 2024 PLR expands on that approach and permits a choice between a defined contribution, a retiree HRA contribution, a health savings account (HSA) contribution, or a student loan payment under a qualified educational assistance program.

PLR Approved Plan Design

Important Approval Caveats

The IRS presented some specific and important caveats in the approval.

-

Employees must make an irrevocable election for their contribution in advance of the plan year.

-

Employees may not receive the employer funds as cash compensation or as any other taxable benefit.

-

Elections for specific plans are subject to additional restrictions as follows:

-

If HSA contribution is elected, employee must be enrolled in a qualifying HDHP

-

If HSA contribution is elected, contribution is subject to the regular HSA limits of $4,300 for individual coverage and $8,550 for family coverage in 2025 (combined between employer and employee contributions)

-

If educational assistance plan contribution is elected, subject to the annual limit of $5,250.

- If retiree HRA is elected, it must be available only as a retiree plan, not as a plan for active employees.

What Motivates This Plan Design?

Most employers offer some type of match or profit-sharing contribution to a retirement plan or 401(k) plan for employees. Many employers also provide other pre-tax benefits, such as contributions to an HSA or benefits under an educational assistance program (for payment of education expenses or student loans through December 31, 2025).

The reality faced by employers is that employees have different life and savings priorities based on life stage and savings goals. Young, single employees may be saddled with student debt. Employees with young families may prefer to prioritize HSA contributions. Other employees may simply prefer to focus on building retirement savings. The reality for most employers is that funding all such programs would break the bank. So, the question becomes, is there a way to provide flexibility to employees and allow them to personally direct a fixed pre-tax contribution individually?

The Taxation Conundrum

For those who need a refresher on tax law, the IRS cares about a concept called “constructive receipt.” In a nutshell, it means:

-

An employee must be taxed in the calendar year in which the employee “constructively receives” the compensation.

-

If an employee is given a choice between cash compensation and a pre-tax benefit, they have “constructively received” the money, therefore it must be taxed in that year.

The requirement to tax an employee, if they have a choice between a pre-tax benefit and a taxable benefit (compensation), can generally be avoided only if the choice is offered under a cafeteria plan. That is the magic of IRC Section 125.

Can Other Employers Adopt this Strategy Now?

No. A Private Letter Ruling only applies to the specific entity that requests the ruling. In this case, the PLR cannot be used to generalize a “blessing” for a flexible choice pre-tax program beyond the specific employer that sought the ruling. That said, this PLR does provide some insight into the IRS’ current thinking on the matter of choice between pre-tax benefits.

Given the uniqueness and desirability offered in this ruling, we expect other employers will want to emulate such flexible plan designs and will submit “mirror” PLR requests. At some point, the IRS may provide general guidance authorizing these types of plans. Realistically, however, that is likely to be years into the future. In the meantime, employers interested in offering these types of arrangements should plan on requesting a PLR from the IRS.

Considerations for the Far Future

While it is not currently possible for employers to offer such plan flexibility, it is not unreasonable to review some employer considerations for the future.

Program Cost: In the case of this private letter ruling scenario, the employer contribution was already earmarked as a discretionary contribution to the 401(k) plan. As such, it didn’t create an additional employer expense. However, for an employer who may be interested in considering a flexible choice plan in the future, the question of “where will the funds come from” will be an important consideration.

Discrimination Testing Issues: Allowing employees to self-direct their employer pre-tax contributions will lead to non-uniform employer contributions to the 401(k), HSA, HRA, and educational assistance plan. While this isn’t necessarily a “math dealbreaker” for employers, it will be important to model the potential impact of a flex-choice plan and not simply assume that employee elections won’t tip the scales of discrimination testing for these new plan choices.

Employee Communication: As if 401(k) plans, HSAs, HRAs, and educational assistance plans aren’t complex enough to explain to employees, a flex-choice program would add a new level of plan design complexity, and a commensurate communication/education effort by the employer would be critical. In addition to simple plan explanation, disclosures about the consequences of each election will also be important. For example, HSA and educational assistance elections might be cut back based on the IRS annual limits. 401(k) and HSA elections may allow self-direction of invested funds, while an HRA option would not. And 401(k) plan contributions may be subject to vesting while the other options are not. Each of these could be considered “gotcha’s” from an employee’s perspective, therefore clear communication and comprehensive disclosure documentation will be a must.

Plan Administration: While generally people love the idea of employee choice, such flexibility also adds an element of complexity to plan administration, and the additional plan administration requirements shouldn’t be overlooked. Following are some of the administration elements to consider:

-

Coordinate Across Multiple Vendors: A flex-choice arrangement would require coordination across multiple plan vendors.

-

Benefit Tracking: Employers would need to either manually cross reference various vendor reports or plan to customize a ben-admin system module for tracking.

-

Coordinate IRS Annual Limits: Employers must confirm that combined employer/employee contribution to an HSA or educational assistance plan don’t exceed the annual IRS limits. The timing of directed employer contributions must also be coordinated. For example, in the PLR, the employer arranged for after-year-end contributions to be made (to avoid coordinating with employee contributions that are a moving target).

-

HDHP Verification: If an HSA option is included, employers may want to verify that employees are enrolled in a qualified HDHP if employer contribution is directed to an HSA.

References

Private Letter Ruling